Working Capital Turnover Ratio is calculated using the formula given below. Working Capital = Current Assets – Current Liabilities Working Capital is calculated using the formula given below What is the Working Capital Turnover ratio of the company? Whose revenue from operations or net sales for a period is $ 15,000, and its current assets and current liabilities for the period are $ 10,000 and $ 7,500, respectively. Let us take another example of a company Mobility Inc. It shows that the inventory turnover ratio is 3 times, and it should be compared to the previous year’s data as well as other players in the industry to get a better sense. Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory Inventory Turnover Ratio is calculated using the formula given below

Cost of Goods Sold = 2,000+ 16,000 – 6,000Īverage Inventory is calculated using the formula given belowĪverage Inventory = (Opening Inventory + Closing Inventory) / 2.We now have all the required inputs to calculate ROE using both the 3-step and 5-step DuPont approaches.Cost of Goods Sold is calculated using the formula given belowĬost of Goods Sold = Opening Inventory + Purchases – Closing Inventory Since there is no debt in the capital structure in the “Downside” case, the total assets must equal the average shareholders’ equity for the balance sheet to remain in balance. Next, we’ll move on to the balance sheet assumptions, for which we only require two data points, the “Average Total Assets” and “Average Shareholders’ Equity” accounts.ī/S Base and Upside Case (Step Function): the value of the hard-coded number in blue font is added to the cell on the left.īase and Upside Case (I/S Step Function): Then, from those figures, we’ll use the following step functions – i.e. We’ll also use a step function and use different step values for the other two cases. Here, we’ll be assessing three different operating scenarios:įor our projections, we’ll use the “Downside” case as our starting point. Suppose we’re tasked with calculating a company’s return on equity (ROE) using the DuPont analysis framework. Operating Scenarios and Balance Sheet Assumptions Operating Margin → The operating profit ( EBIT) retained per dollar of sales after deducting cost of goods sold (COGS) and operating expenses (OpEx).Īll three of these new parts are extensions of the net profit margin calculation.Interest Burden → The extent to which interest expense impacts profits.Tax Burden → The proportion of profits retained post-taxes.

To expand further upon the additional parts of this formula: There are two additional components in the 5-step equation as compared to the 3-step equation.

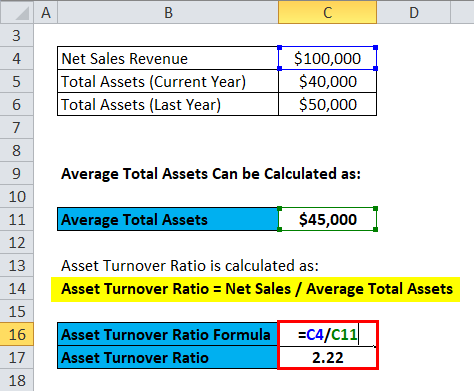

The five components of the 5-step DuPont formula are the following ratios: Enroll Today 5-Step DuPont Analysis Formula Enrollment is open for the May 1 - Jun 25 cohort. Level up your career with the world's most recognized private equity investing program. The starting point to arrive at these three components is the return on equity (ROE) formula.Īnd Wall Street Prep Private Equity Certificate Program Financial Leverage Ratio = Average Total Assets ÷ Average Shareholders Equity.Asset Turnover = Revenue ÷ Average Total Assets.Net Profit Margin = Net Income ÷ Revenue.In a 3-step DuPont analysis, the equation states that if a company’s net profit margin, asset turnover, and financial leverage are multiplied, you will arrive at the company’s return on equity (ROE).Īs the simpler version between the two approaches, the return on equity (ROE) is broken into three ratio components: Originally devised in the 1920s by Donaldson Brown at DuPont Corporation, the chemical company, the model is used to analyze the return on equity (ROE) as broken down into different parts in order to analyze the contribution of each part. DuPont Analysis is a framework used to break apart the underlying components of the return on equity (ROE) metric to determine the strengths and weaknesses of a company.

0 kommentar(er)

0 kommentar(er)